ECONOMIC ANALYSIS OF MARKETING OF POMEGRANATES INARGHANDAB DISTRICT, KANDAHAR PROVINCE,AFGHANISTAN.

0 Views

ABDUL RAZIQ REHAN*, I. BHAVANI DEVI, S. RAJESWARI and P. LAVANYA KUMARI

Institute of Agribusiness Management, S.V. Agricultural college, ANGRAU, Tirupati 517502, Chittoor Dt., A.P.

ABSTRACT

The study was conducted to identify marketing channels, price spread, marketing costs and margins of pomegranates in Afghanistan. Five marketing channels were found operating in pomegranates. Highest percentage of sales took place through channel I in pomegranates i.e. Producer- wholesaler- retailer- consumer. In this channel 63.33 per cent of produce was disposed.The sample farmers had incurred an amount of Rs. 705.7 in marketing one quintal of pomegranates towards crate charges, transportation, labour expenses and commission agent’s fee. The wholesaler incurred an amount of Rs. 701.42 towards marketing costs comprising crate charges, transportation, labour charges and spoilage. For the retailer major costs were crate charges and spoilage. The producer’s share in consumer’s rupee was 31.12 per cent. The marketing costs incurred by farmer was Rs. 705.7 thereby receiving a net price of Rs. 2031.31 per qtl of pomegranates. The marketing costs and margin of wholesaler were Rs.701.42 and Rs.1060.97 and the corresponding figures for retailer were Rs. 677.74 and Rs.1348.66. The margin of wholesaler and retailer was 16.25 and 20.66 per cent respectively.

KEYWORDS:

Supply chain, price spread, marketing costs

INTRODUCTION

Pomegranate (Punica granatum L.) belongs to family Punicaceae and is a fruit of the tropical and sub-tropical regions of the world. Pomegranate cultivation was started since ancient times. The fruit is a native of Iran and extensively cultivated in Mediterranean countries like Spain, Egypt, Iran, Burma, China, India and Afghanistan. Pomegranate production is a significant contributor to the Afghan’s agricultural economy. Pomegranate is a major fruit crop in many provinces such as Kandahar, Helmand, Wrdak, Ghazni, Paktia, Farah, Kapisa and Balkh, and is a source of the livelihoods of thousands of people.Currently about 2 per cent of the production in Afghanistan is from pomegranates.The main production area of pomegran-ates is in the Kandahar Province, where 806 ha of area was under pomegranate cultivation in 2015. In 2018 the productivity per ha of land was also very high in Arghandab districts of the province with yield of 9.2 t ha-1).Pomegranates from Kandahar province have his-torically been widely known for high quality. Annual pro-duction in the Kandahar Province is approximately –

1,000,00 tons and the main cultivar is ‘Kandahari’. The variety of pomegranate grown in Kandahar is known as the jumbo, ruby-red Kandahari variety, while the seed-less variety is known as Badana, which is good for table purpose or converting into juices.Different varieties of pomegranates are produced in Afghanistan and supplied to the local markets. Though the maturity time of the crop varies according to the climatic conditions, usually the fruit comes into the market during summer and continues into the fall season. The quantity supplied increases during the fall and relatively the price decreases. Since cold stor-age facilities are not available, farmers are forced to sell the fruit immediately after harvest. A large portion of the pomegranates is exported to nearest markets due to avail-ability of transportation.

MATERIALS AND METHODS

The cultivation of pomegranates in Kandahar prov-ince is concentrated mainly in the district of Arghandab because of the favourable conditions for the production and marketing of pomegranate, hence the district was selected purposively for the present study.

In the district of Arghandab five villages with highest area under pomegranates purposively were selected. The vil-lages thus selected were Nagahan, Khaisrow, Tabin. Khaishki and Kowack. From the villages so selected 6 farmers from each village representing for pomegranates were randomly selected. In all the size of sample farmers stood at 30.The primary data was collected from farmers through personal interview method by a using schedule. The primary data pertain to the year 2017-18.

Marketing cost and margin

The concurrent margin has been estimated, as it

is the difference between the price prevailing at successive stages of marketing at a given point of time, e.g., the difference between farmer’s selling price and retail price on a specific date is the total concurrent margin. To study the existing marketing system, marketing margins and cost for different channels in the selected markets the price spread was estimated by using the following formulae.

Market Margin of ithMiddlemen (Ami)

Where,

Ami = Market margin of ithmiddlemen

Pri= Total value of receipts per unit (sale price)

Ppi= Purchase value per unit (Purchase price)

Cmi= Cost incurred on marketing per unit by the ith middlemen

Total marketing cost

C= Cf+Cm1=Cm2+Cm3+…….+Cmn

Where,

C= Total cost of marketing of the commodity

CF= Cost paid by the producer from the time the produce leaves the farm till he sells it

Cmi= Cost incurred by the ith middlemen in the process of buying and selling the produce

Producer’s price

The producer’s price is the net price received by the farmer at the time of first sale. This is the equal to the wholesale price at the primary assembling centre, minus the charges borne by the framers in selling.

Pf= PA-Cf

Where,

PA= is the wholesale price

Cf= is the marketing cost

incurred by farmer

Pf= is the producer’s price

RESULTS AND DISCUSSION

The supply chain of pomegranates is presented below.The pomegranates in the study area were marketed through five channels from producers to the ultimate consumers. The channels are as follows:

Channel I: Producer-wholesaler-retailer – consumer

(63.33%). Channel II: Producer- market yard- wholesaler

– retailer – consumer (30.00%). Channel III: Producer-exporter- retailer– consumer (30.00%). Channel IV: Producer- consumer (10.00%). Channel V: Other specify (Producer – retailer – consumer) (3.33%).

In Channel-I, the producer sold the pomegranates to the wholesaler in the garden contract just before harvesting and later the wholesaler took the function of packing was responsible for packing and then sold to retailer and turn to consumer. In this channel 63.33 per cent of produce was disposed. Similar results were obtained by Sarma et al. (2018).

In channel-II the producer himself brought the produce to the market yard and sold to the wholesaler by open auction system the farmer himself was responsible for packing. The wholesaler sold the produce to retailer and then retailer to consumer. 30.00 per cent of the produce was sold through this channel.

In channel III- The farmer sold the produce to the exporter, on the farm who directly exported the produce to the imported market and then the produce moved to retailer and consumer. In this channel (III) 30.00 per cent of the pomegranates were sold by the farmers.

In channel IV- the producer himself sold the produce to the consumer either in field or elsewhere in the city. This happened when the farmers were unable to sale the produce through traders. 10.00 per cent of the produce were sold through this channel by the farmers of pomegranates.

In channel V- the farmers sold the produce through retailer. Retailer directly contacted the farmers and have undertaken the purchases. Then retailers disposed to the consumers (3.33%).

Marketing costs for pomegranate

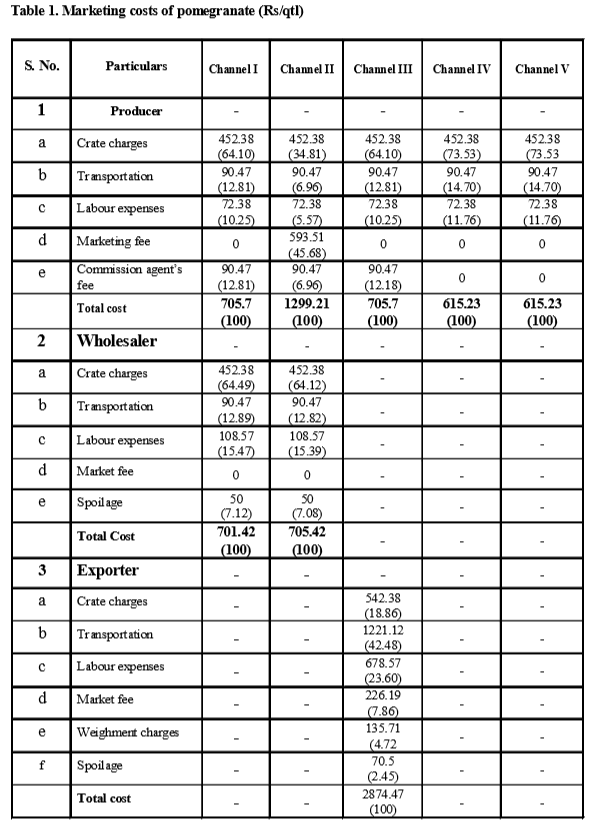

Marketing costs are the sum total of costs incurred in the movement of produce and they include costs such as crate charges, transportation, market fee, commission charges etc. The concurrent margin has been estimated, as it is the difference between the price prevailing at successive stages of marketing at a given point of time.The marketing costs incurred by producer as well as the market intermediaries in the marketing of pomegranates were worked out for the marketing channels identified and presented in Table 1.

Price spread

Price spread is defined as the difference between the price received by the farmer and the price paid by the consumer expressed as a percentage to the latter.

REFERENCES

- Anchal, D and Sharma, V.K. 2009. Price spread of litchi in Punjab. Indian Journal of Agricultural Marketing. 23(2): 147-150.

- Anil Bhat, Jyoti Kachroo and Dileeo Kachroo. 2011. Economic appraisal of kinnow production and its marketing under North- Western Himalayan region of Jammu. Agricultural Economics Research Review. 24(2) 283-290.

- Sarma Amiya, Tinku Moni Borah and Madhurjya. 2018. Efficacy of marketing channels of horticultural crops: A study in Assam, Department of Economics Gauhati. Indain Journal Agricultural Marketing. 32(2): 2.

CONCLUSION

Five marketing channels were found operating in pomegranates. Highest percentage of sales took place through channel I in pomegranates i.e. Producer- whole-saler- retailer- consumer. The pomegranate sample farm-ers had incurred an amount of Rs. 705.7 in marketing one quintal of pomegranates towards crate charges, transpor-tation, labour expenses and commission agent’s fee in channel I. Crate charges was the major item accounting for 64.10 per cent of total costs. The price spread analy-sis of pomegranate duly revealed that the producer’s shares in consumer’s rupee ranged from 18.93 to 86.40 per cent for the channels that were identified. The high-est net price was realized by the farmers when the fruits were sold to the consumers directly.

- Bio-Formulations for Plant Growth-Promoting Streptomyces SP.

- Brand Preference of Farmers for Maize Seed

- Issues That Consumer Experience Towards Online Food Delivery (Ofd) Services in Tirupati City

- Influence of High Density Planting on Yield Parameters of Super Early and Mid Early Varieties of Redgram (Cajanus Cajan (L.) Millsp.)

- Influence of Iron, Zinc and Supplemental N P K on Yield and Yield Attributes of Dry Direct Sown Rice

- Effect of Soil and Foliar Application of Nutrients on the Performance of Bold Seeded Groundnut (Arachis Hypogaea L.)