The Benefits to Farmers From Fpo’s Accessing Agri Value Chain Finances

0 Views

N. VENKATA KALYANI*, Y. PRABHAVATHI, P. NAGI REDDY AND P. LAVANYA KUMARI

Institute of Agribusiness Management, S.V. Agricultural College, ANGRAU, Tirupati-517 502.

ABSTRACT

Agriculture is undergoing a significant transformation from fragmented production and marketing to integrated marketing systems. This transition driven by the need for enhanced competitiveness, efficiency and productivity in the global marketplace, underscores the critical role of agricultural value chains. In this context, Farmer Producer Organizations (FPOs) play a vital role in integrating to agri value chains through increasing their access to inputs, outputs and finances. The present study conducted during 2024-25 in Guntur and Prakasam districts of Andhra Pradesh state explores the benefits realized by member farmers of FPOs through FPOs accessing the agri value chain finance. The sample comprised of ten FPOs and 100 member farmers. The data was collected using a structured interview schedule and analysed using percentage analysis and mean scores. The results indicated that Value chain financing significantly enhanced input access and social benefits for FPO member farmers, notably improving trust and timely input supply. However, trade and financial benefits remained limited due to minimal procurement involvement and lack of credit services. Expanding these areas has the potential of leveraging the full potential of value chain finance resulting in strengthening of FPO effectiveness and improving farmer livelihoods

KEYWORDS: Agri value chain finance, Farmer Producer Organization, input access, social benefits, trade benefits.

INTRODUCTION

Agriculture plays a critical role in many economies, particularly in rural areas, where it is vital for socio- economic development. Despite various initiatives, Indian farmers, especially smallholders, continue to face significant challenges in accessing timely and adequate institutional finance. Factors such as lengthy production cycles, high operational costs, inadequate collateral, poor credit histories, weather uncertainties, and the geographical distance of financial institutions contribute to these challenges (Miller and Jones, 2010; Soundararajan and Vivek, 2015). As a result, farmers often rely on informal credit sources, which further exacerbates their financial difficulties and limits their ability to invest in modern farming techniques and capital assets.

Farmer Producer Organizations (FPOs) have emerged as crucial intermediaries in improving smallholders’ access to inputs and markets. However, accessing finance remains a formidable challenge for FPOs due to traditional financing structures that rely heavily on collateral and creditworthiness. Value chain finance (VCF) offers a promising solution by providing a platform that connects participants across the entire agricultural value chain, enabling the development of customized financial products tailored to the specific needs of farmers and FPOs. This approach reduces financing costs and risks while extending services to smallholder farmers, thereby enhancing the efficiency and sustainability of agricultural value chains.

Despite the potential of VCF, the agricultural sector in India is still experiencing a lack of innovative financial products and services (Soundararajan and Vivek, 2015). However, some pioneering financial institutions, such as Samunnati, have introduced innovative financial and non-financial solutions tailored to various agricultural value chain players, including FPOs thereby addressing the constraints faced by FPOs in accessing finance and adding value to every stakeholder in the agricultural value chain (Patel et al., 2016). Therefore, present study is aimed to explore the benefits derived by farmers due to their FPOs accessing agri value chain financing.

MATERIAL AND METHODS

Guntur and Prakasam districts, were selected purposively for this study as FPOs in these districts are availing value chain financing from financial institutions like Samunnati along with very few public and private sector financial institutions. A list of FPOs who accessed agri value chain finance were obtained and a random of 10 FPOs were identified, from each FPO, 10 farmers were randomly selected, thus making sample of 100 member farmers for the study. To analyse the benefits realized by sample member farmers from FPOs accessing innovative agri value chain finances, data was collected using a well- structured interview schedule. The schedule comprised of nineteen statements developed on a five-point Likert scale, with responses ranging from “strongly disagree” to “strongly agree ” and accordingly corresponding scores of 1, 2, 3, 4, and 5 respectively were given. The statements were grouped into benefit categories namely social, input accessibility, trade and financial for better understanding. The mean score of each statement was computed and ranked accordingly. Mean values below 3 indicates low levels of benefits realized, values between 3 and 4 indicated a moderate level, and values above 4 indicated a high level of benefit derived by the member farmers. The data, pertaining to the agricultural year 2024–25, was analysed using percentage analysis and mean score calculations, with rankings assigned based on the computed means.

RESULTS AND DISCUSSION

Profile characteristics of sample member farmers

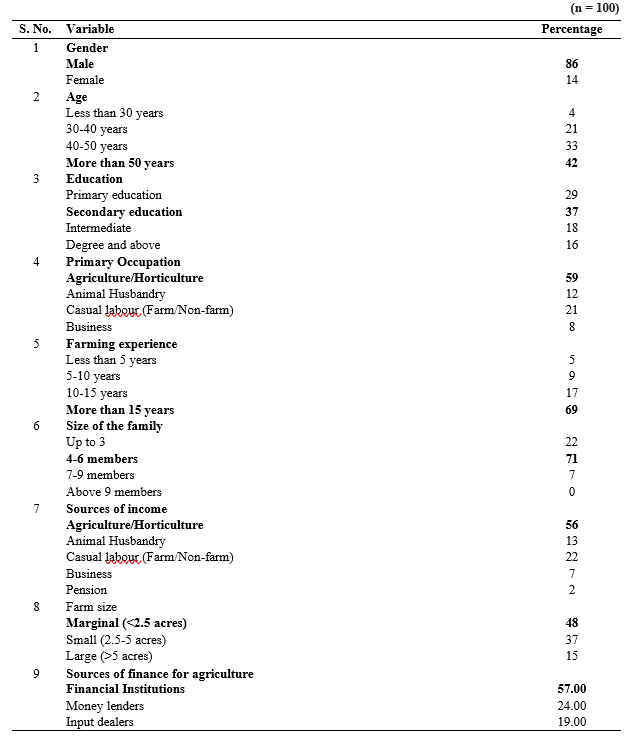

The data related to socio-economic characteristics of sample respondents including gender, age, education, occupation, farming experience, family size, sources of income, farm size, crops grown, sources of finance for agriculture, details regarding agri value chain finance accessed were collected and analysed. The results were obtained and presented in Table 1.

Table 1 inferred that, among the sample respondents, majorly 86 per cent of sample farmers were male, 42 per cent were in the age group of more than 50 years, had secondary education (37%), while 59 per cent had agriculture/horticulture as their primary occupation,69 per cent had more than 15 years farming experience and with family size of 4-6 members (71 %). Coming to sources of income, around 56 per cent were having Agriculture/Horticulture as a primary source of income. Majority of the sample farmers were marginal with less than 2.5 acres of agricultural land (48 %). Regarding to sources of finance for agriculture, 57 % of the sample respondents had availed finance from financial institutions

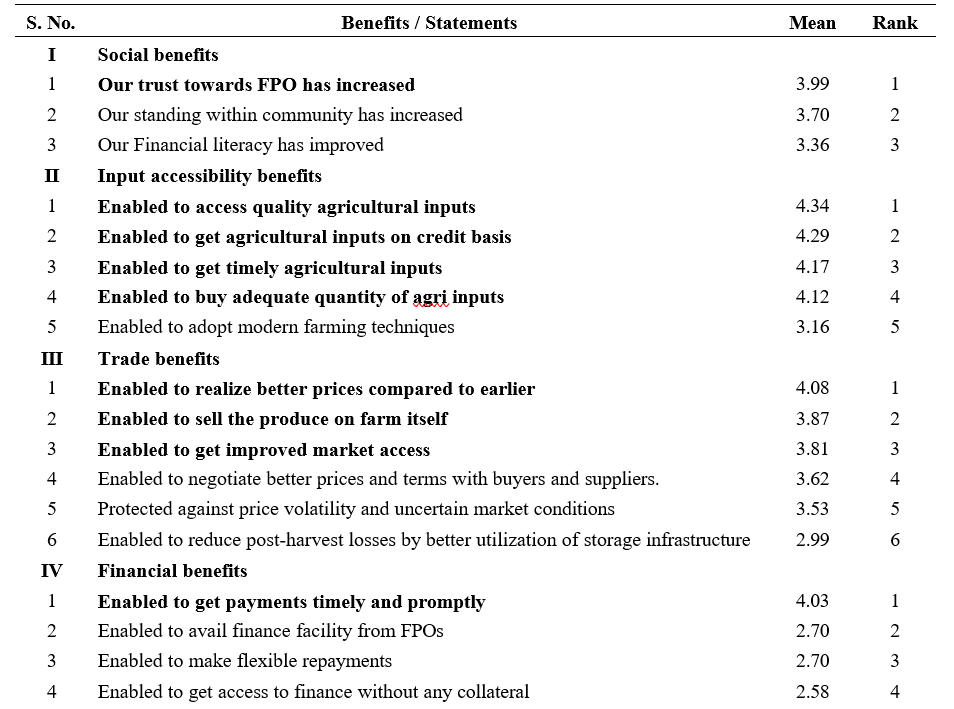

Benefits to FPO farmers from FPOs accessing agri value chain finances

The results presented in Table 2 indicate that among social benefits, the primary advantage for farmers from FPOs accessing agri-value chain finances was the enhancement of trust (Rank 1), followed by improved networking (Rank 2). This indicates that farmers’ confidence in their FPOs has grown, likely due to more reliable support and services. Additionally, their ability to connect with alternate buyers and other community members has strengthened. Thus, integration with value chains fosters trust, effective collaboration ((Milder, 2008), while also strengthening linkages through improved networking (Patel et al., 2020). The impact on financial literacy was relatively neutral (Rank 3), indicating that while there may be some improvement, it was not as significant as other social benefits. This could imply a need for more targeted financial education programs within FPOs to further enhance farmers’ financial skills and understanding.

Regarding input accessibility benefits, the member farmers were able to ger access to quality agricultural inputs (Rank 1), get inputs even on a credit basis (Rank 2). Further, they were also able to obtain these inputs as and when required (Rank 3) and in adequate quantities (Rank 4). This indicates that increased financial access enabled FPOs to secure and distribute high-quality inputs more effectively, which in turn benefited the farmers. Results align with findings of Chen et al. (2015) who noted the significance of internal financing within value chains for the provision of inputs. However, the adoption of modern farming technologies (Rank 5) was not as widespread, possibly due to limited exposure to these technologies, inadequate training or higher costs associated with adopting new techniques.

In terms of trade benefits, farmers reported receiving better prices for their produce (Rank 1) followed with convenience of selling their produce on-farm (Rank 2). Improved market access (Rank 3) was also noted, which is likely due to the FPOs’ ability to purchase directly from farmers, reducing the need for intermediaries and lowering transaction costs. However, farmers’ bargaining power (Rank 4) remained limited, possibly due to their small-scale operations. The protection against price volatility (Rank 5) was also moderate, indicating that while FPOs offer some stability, external market conditions still pose risks. Additionally, the low ranking of reduced post-harvest losses (Rank 6) suggests that the farmers in the study area had limited access to storage facilities, compelling them to sell at current market prices rather than holding out for better prices.

The primary financial benefit identified by farmers was the ability to receive timely payments (Rank 1). This prompt payment was possible because FPOs were able to secure the necessary value chain finance from financial institutions to purchase produce from farmers without delays. The study found that FPOs currently do not provide any direct financing facilities to their member farmers. Thus, the components namely finance accessibility and flexible repayment options (both Ranked 2) and collateral-free financing (Rank 3) had not resulted in any direct benefits to member farmers . Nevertheless, many farmers expressed that if FPOs were to offer financial services, it would significantly

Table 1. Profile characteristics of sample FPO member farmers

Table 2. Benefits to FPO farmers from FPOs accessing agri value chain finance

enhance their ability to secure timely financing. This, in turn, would enable them to carry out farm operations more effectively and make necessary capital investments without delays aligning with the tailored solutions advocated by Patel et al. (2020). Such financial support would likely deepen their trust in FPOs, encouraging them to purchase all their agricultural inputs through these organizations. This increased reliance on FPOs would not only benefit the farmers by providing a more integrated support system but also boost the business and financial stability of the FPOs themselves. By addressing these gaps and introducing financial services tailored to farmers’ needs, FPOs could further strengthen their role in supporting sustainable agricultural practices and enhancing the economic well-being of their members.

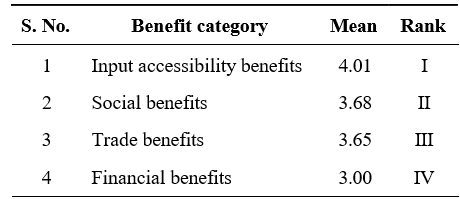

Ranking of Benefit Categories:

The results in Table 3 revealed that the important benefit realized by FPO farmer members was related to input accessibility (Rank 1). This high ranking is attributed to many FPOs successfully securing value chain financing from financial institutions, which allowed them to procure and distribute high-quality agricultural inputs more effectively. The ability to provide timely and adequate quantities of inputs to member farmers was a key factor in this benefit. This efficient distribution of inputs also contributed to an increase in farmers’ trust in their FPOs, leading to a strong social benefit (Rank 2). The enhanced trust not only strengthened the relationship between farmers and their FPOs but also facilitated better networking within the farming community.

Trade benefits (Rank 3) ranked third, largely due to the efforts of some FPOs to create alternative market access by directly procuring produce from member farmers. This practice allowed farmers to sell their produce conveniently on-farm, which, combined

Table 3. Ranking of benefit categories by FPO farmers regarding agri value chain finance

with the prompt payments facilitated by FPOs, further reinforced trust in these organizations. However, since not all FPOs are involved in the direct procurement of farm produce, the overall impact on trade benefits was somewhat limited. Financial benefits (Rank 4) were the least realized among the benefit factors. While timely payments provided some financial relief to farmers, the overall financial benefit was less pronounced, mainly because most FPOs did not offer direct financial services such as credit or flexible repayment options. The limited financial support available from FPOs suggests that there is room for growth in this area.

In summary, the study highlights that input accessibility was the most significant benefit for FPO members, as many FPOs are primarily engaged in the business of supplying agricultural inputs. Conversely, the impact of trade and financial benefits was lower, partly due to the limited number of FPOs involved in produce procurement and financial service provision. This indicated the need for FPOs to expand their role in these areas to provide more comprehensive support to their members.

The study indicated the benefits realized by FPO member farmers through FPOs accessing value chain financing. Among the benefits, the critical role of input accessibility identified as the most significant benefit realized by FPO farmer members, driven by the FPOs’ ability to secure value chain financing. This access enabled timely and adequate distribution of high- quality agricultural inputs, which in turn strengthened farmers’ trust and improved their social standing within their communities. Further, trade and financial benefits were less impactful, highlighting areas where FPOs could expand their services. The limited involvement in direct produce procurement and the absence of financial services like credit and flexible repayment options reduced the overall benefits to farmers.

CONFLICT OF INTEREST

No Conflict of Interest

LITERATURE CITED

Chen, K.Z., Joshi, P.K., Cheng, E and Birthal, P.S. 2015. Innovations in financing of agri-food value chains in China and India: Lessons and policies for inclusive financing. China Agricultural Economic Review. 7(4): 616-640.

Milder, B. 2008. Closing the gap: reaching the missing middle and rural poor through value chain finance. Enterprise Development and Microfinance. 19(4): 301.

Miller, C and Jones, L. 2010. Agricultural value chain finance. Tools and lessons. Practical Action.

Patel, B.K., Kumar, A and Singh, R.K. 2016. Role of farmer producer organizations in agricultural development: A study in Gujarat. Indian Journal of Agricultural Economics. 71(1): 83-97.

Patel, N., Roy, D and Sharma, S. 2020. Impact of value chain financing on smallholder farmers’ income and access to markets: Evidence from India. Journal of Development Studies. 56(7): 1301-1318.

Soundararajan, P and Vivek, N. 2015. A study on the agricultural value chain financing in India. Agricultural Economics. 61(1): 31-38.

- Effect of Sowing Window on Nodulation, Yield and Post – Harvest Soil Nutrient Status Under Varied Crop Geometries in Short Duration Pigeonpea (Cajanus Cajan L.)

- Nanotechnology and Its Role in Seed Technology

- Challenges Faced by Agri Startups in Andhra Pradesh

- Constraints of Chcs as Perceived by Farmers in Kurnool District of Andhra Pradesh

- Growth, Yield Attributes and Yield of Fingermillet (Eleusine Coracana L. Gaertn.) as Influenced by Different Levels of Fertilizers and Liquid Biofertilizers

- Consumers’ Buying Behaviour Towards Organic Foods in Retail Outlets of Ananthapuramu City, Andhra Pradesh