MARKETING OF PACKAGED LIQUID MILK IN HYDERABAD CITY – A COMPARATIVE STUDY OF TOP TEN DAIRY FIRMS.

0 Views

M. PARIKSHITH*, P. RADHIKA2, SEEMA3 and SRINIVASA CHARY4

School of Agribusiness Management, Professor Jayashankar Telangana state Agricultural University, Rajendranagar, Hyderabad- 500030, Telangana.

ABSTRACT

Efficient marketing of packaged branded liquid milk is important for the profitability of dairy firms. To know about the marketing of milk by dairy firms, a comparative study of dealers margins, price, value and volumes by each dairy firm per day have been studied in Hyderabad city, by surveying a sample of 160 dealers from nine different areas of Hyderabad. The price range differs among various brands by Rs 1 to Rs 3, and margins vary between Rs 2.5 to Rs 4.5. The total volume of milk sold per day in the study area on an average is 2,40,330 litres and the value worked out to Rs 1,05,76,490 per day.

INTRODUCTION

The dairy industry in India is still mostly unorganised dominated by small and marginal dairy farmers. As the industry possesses huge untapped opportunities, it has attracted a number of private companies and investors.

Currently, 48 per cent of total milk produced is either consumed at the producer level or sold to non producers in the rural area. The balance 52 per cent of the milk (marketable surplus) is available for sale to consumers in urban centers. Of this 52 per cent, currently, about 40 per cent of the milk sold is handled by the organized sector (Dairy cooperatives and producer companies – 21 per cent and private dairies- 19 per cent) and the remaining 60 per cent by the unorganized sector. (Anonymous, 2017).

The private dairy sector is concentrated in Maharastra and Uttar Pradesh, which have around 58 per cent of the total number of dairies in the country among the total dairy units in India. Andhra Pradesh, Gujarat, Karnataka, Tamilanadu, Punjab, Haryana, Kerala, West Bengal, Rajasthan and Madhya Pradesh have around 31.71 per cent of total dairy units. (Indiastat, 2017)

In the Telangana region Lactalis Tirumala dairy procures two lakh litres of milk per day and sells 1.20 lakhs in Hyderabad market as liquid milk and the rest of

the milk is processed into various milk products. (The processing plant of the company in Telangana is located at Gungal village, Yacharam Mandal in Ranga Reddy district)

Lactalis Tirumala is using different market penetration strategies and methods to expand its market reach in Hyderabad market. It has started exclusive retail outlets in various parts of Hyderabad apart from supplying milk through agents and retailers. The company is keen on knowing its efficiency and effectiveness of market reach in comparison to other major brands supplying milk in Telangana. Hence this papers presents the comparative position on the Thirumala brand and its major competitors with respect to the prices, dealers margin given by the firms and also the average value and volume of milk sold by various dairy firms per day.

MATERIALS AND METHODS

The study was conducted in nine areas of Hyderabad city, which were purposively selected based on the companies recommendations. For the study top ten dairy brands operating in Hyderabad have been con-sidered. . From all the areas 20 dealers were selected randomly, except from Kattedan and Rajendranagar ar-eas, from where 10 dealers each were selected. Thus the total sample consisted of 160 dealers. All the necessary information required for the research was collected through survey method, by personally interviewing the respondents (dealers) using the pre-tested schedule. Both

quantitative and qualitative data was collected to fulfil the objectives of the study. Primary data was collected using a schedule and the source of secondary data included research papers, books, journals, websites, company records and dealer’s records. Simple descriptive statistics have been used to analyze the data apart from using scaling and ranking techniques.

RESULTS AND DISCUSSION

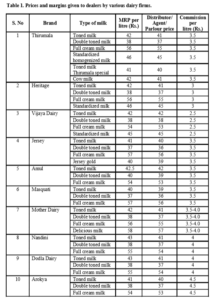

Prices and margins given to dealers by various dairy firms.

The marketing efficiency depends on the prices and margins offered to dealers by various companies. The companies also come up with various variants of milk to retain the consumers. The data with respect to 10 major brands of liquid milk operating in Hyderabad has been collected and is presented in the following table.

The data shows that all the companies have at least three variants, which are in common, they are toned milk, double toned and full cream milk, the price range for toned milk is from Rs 40- Rs 43, and Nandini dairy is selling at Rs 43 and Jersey is selling at Rs 40. For double toned milk price range was from Rs 37 to 40, with Masquati and Vijaya dairy pricing this variant was at Rs 37 and Jersey pricing at Rs 40. For full cream milk, prices vary from Rs 54 to 57, with Heritage pricing at Rs 54 and Vijaya, Masquati pricing it at Rs 57. It can be observed that Thirumala brand milk is priced in between the two extremes for all the variants of milk.

With regard to margin given to the dealers for litre of milk, Vijaya gave least margin of Rs 2.5 per litre, where as Arokya gives highest margin of Rs 4.5. Since Arokya is a new entrant into the market, it gives high margins to dealers to attract the dealers. Thirumala brand gives Rs 3.5 per litre as margin to the dealers, which is on par with 40 per cent of brands considered for study, 20 per cent brands are giving higher margin than Thirumala brand, where as 30 per cent brands are giving less margin than Thirumala brand. All dairy firms are charging the dealer one rupee less than the M.R.P for a litre of milk. Hence it can be noticed that Thirumala brands pricing of various variants is neither too low or too high, at the same time margins (commission) given to dealers are also on par with most of the firms.

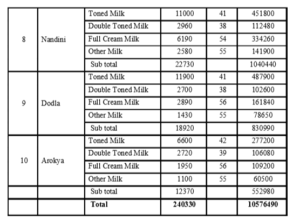

Average value and volume of milk sold by respon-dent dealers per day.

The dealers of milk usually deal with 6 or 7 brands of milk. The data was collected from the all respondent dealers as to know how much milk of various variants they sell per day. The data so obtained was tabulated and presented in the table .1.

The table shows that in the study area all the respondent dealers cumulative sales per day was 2,40,330 litres and the value worked out to Rs, 1,05,76,490 per day. The sales of Heritage brand were highest in the study area. The sale of Heritage brand liquid milk is 43.15 per cent more than Thirumala milk. Vijaya dairy has the second highest sales in the study area, it sales more 9.80 per cent more than Thirumala milk, Thirumala brand has the third highest sales in the study area with a sale 270330 litres per day. Jersey sales are 10.47 per cent less than Thirumala milk where as Nandini and Dodla sales are less than by 17.76 per cent and 31.54 per cent. Mother dairy sales are less than Lactalis Thirumala sales by 31.80 per cent and the sale of Masquati and Amul are less by 40.30 per cent 30.17 per cent than Thirumala sales.

From the opinions gathered from dealers it was seen that Masquati sells mostly in old city area, due to religious sentiments and Heritage sales were more in areas where the percentage of migrant population from Andhra Pradesh is high.

Among the various variants of milk for all brands the sale of toned milk is highest, followed by double toned

milk, full cream milk, and other categories like standardized toned milk, Heritage special, cow milk and Jersey gold.

The total sale of toned milk per day for all the brands the sale by 41.06 per cent of the total sale of liquid milk in the study area. In case of toned milk, Heritage has 25.20 per cent share among all other brands. Compared with Thirumala, Heritage has 54.70 per cent more sale, Vijaya has more than 5.2 per cent sales and Jersey has 5.26 per cent more sales than Thirumala. Dodla has 30.24 per cent less sales than Thirumala milk, followed by Mother dairy which was 31.48 per cent less than Lactalis Thirumala sale of toned milk, Nandini sales less than Thirumala by 37.03 per cent. Whereas Amul sales are less by 46.29 per cent, Masquati 54.62 per cent and Arokya sales are 64.19 per cent less than Thirumala milk. The total sale of double toned milk for all the brands sale by 13.79 per cent. Heritage has the highest sales of 17.64 per cent of the total sales of double toned milk put to-gether. Compared with Heritage, Thirumala has 29.90 per cent less sales than Heritage, Jersey sales same volume of double toned milk as Thirumala. Thirumala sales of double toned milk are more than Mother dairy by 31.70 per cent, followed by Nandini 31.70 per cent, Dodla by 39.02 per cent, Amul by 44.63 per cent and Masquati by

Sale of full cream milk for all the brands sale by 14.41 per cent of the total liquid brand milk sale. Nandini has the highest sale of 17.86 per cent. Compared with Nandini, Thirumala sales are less than 5.0 per cent. Compared with Thirumala, Vijaya sales are less by 12.06 per cent and Heritage sales are less by 13.26 per cent, followed by Dodla which is less by 50.85 per cent, Mother dairy sales are less by 66.66 per cent and same is the case with Arokya milk.

The sale of other variants of milk is around 6 per cent of total sales of milk in the study area. Nandini has the highest sales in this category with sales to the tune of 17.55 per cent of the total sale of milk in the study area, and the least sales are of Thirumala brand. Nandini has 63 per cent more sales than Thirumala and Vijaya has around 54 per cent more sales than Thirumala. The sales of Heritage are more by 53 per cent than Thirumala and it is Jersey sales are more by 46 per cent. Sales of Arokya are more by 42 per cent than Thirumala and sale of Masquati are more by 17 per cent than Thirumala in this category of milk. The total value of milk sold by Thirumala was Rs 12,38,880 per day which was less than Heritage sales of Rs 21,11,950 by 58.66 per cent, Vijaya by 8.25 per cent. The total sale of Thirumala are more than Jersey by 12.73 per cent, more than Nandini by 16.01 per cent, Masquati by 30.17 per cent, Dodla by 31.54 per cent, Mother dairy by 31.80 per cent and Amul by 30.17 per cent.

Thirumala occupied 4th position in the sale of toned milk, 3rd in position with respect to double toned milk, 2nd position in full cream category and in others category it has the least volume of sale among all the brands considered in study.

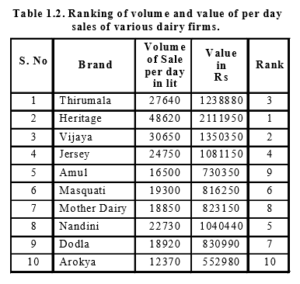

Hence, in terms of volume of sales per day and value, Heritage is in the first position, Vijaya is the second position and Thirumala is in the third position. Jersey is in the 4th position, followed by Nandini, Masquati, Dodla, Mother Dairy, Amul and Arokya.

CONCLUSIONS

The price range for all variants of milk of all brands vary by Rs 1 to Rs 3. Thirumala brand prices its different variants of milk in between the extremities of price range. For one litre of milk the margins provided by all dairy firms ranges between Rs 2.5 to Rs 4.5, with Vijaya giving least margin of Rs 2.5 and Arokya giving highest margin of Rs 4.5. Thirumala gives a margin of Rs 3.5 by 50 percent of surveyed brands. The sale of Heritage milk is almost 1/5th of the total sale of milk in the study area by volume, Thirumala has a sale of 12 per cent of the total sales volume. The total three brands Heritage, Vijaya, Thirumala took up 45 per cent of total market share of packaged milk.

Among all the variants of milk the sale of toned milk was highest, which is almost 42 per cent of the total sale of milk by volume.

REFERENCES

Anonymous, 2017. Department of Animal husbandry dairying and fisheries, Ministry of agriculture and farmers welfare. Government

of India.

Indiastat, 2017. Milk production. https:// www.indiastat.com accessed on 22.06.2018

- Bio-Formulations for Plant Growth-Promoting Streptomyces SP.

- Brand Preference of Farmers for Maize Seed

- Issues That Consumer Experience Towards Online Food Delivery (Ofd) Services in Tirupati City

- Influence of High Density Planting on Yield Parameters of Super Early and Mid Early Varieties of Redgram (Cajanus Cajan (L.) Millsp.)

- Influence of Iron, Zinc and Supplemental N P K on Yield and Yield Attributes of Dry Direct Sown Rice

- Effect of Soil and Foliar Application of Nutrients on the Performance of Bold Seeded Groundnut (Arachis Hypogaea L.)