Brand Loyalty of Urban and Rural Consumers Towards Branded Edible Oils in Chittoor District of A.p.

0 Views

B. SUPRAJA*, S. RAJESWARI, N.T. KRISHNA KISHORE AND P. LAVANYA KUMARI

Institute of Agribusiness Management, S.V. Agricultural College, ANGRAU, Tirupati.

ABSTRACT

The main objective of the study is to know the consumers brand loyalty towards branded edible oils. The study was based on a sample of 60 rural and 60 urban consumers. The findings of the study revealed that majority of the urban consumers of branded edible oils were brand loyal compared to the rural consumers. The main reason for switching to other brand by the urban respondents was that the competitor’s brand was very good in quality, whereas rural consumers were shifting to another brand due to the price of the current brand is very high. Majority of the respondents were not aware about the various edible oil brands available in the market.

KEYWORDS:

Andhra Pradesh, Brand loyalty, Chittoor and Edible oil.

INTRODUCTION

Edible oils compose a principal component of food expenditure in the Indian households. India is the third largest consumer of edible oils after China and the EU countries. In India people in different regions uses different oils based on the taste and availability of local oils. People in northern and central part of India mostly prefer soya bean oil due to local availability of soya bean. In the east and north east part of India people mostly prefer mustard oil since of its use in the local cuisine. In southern part of India Groundnut oil, sunflower oil, coconut oils are widely consumed apart from this palm oil is also mostly used due to easy availability from south east Asia.

Increasing disposable income and rising consumer awareness about healthy lifestyle boosted the consumption of packaged edible oil in the country. Strong marketing activities of leading edible oil brands, changing buying behaviour of consumers, establishment of modern grocery retailers like hypermarkets and supermarkets, shifted the consumption pattern of edible oils towards branded oils. Brand loyalty places an important role to get more revenue by the edible oil companies. Brand loyalty can be defined as the extent of consumer faithfulness towards a specific brand and this faithfulness is expressed through repeat purchases and other positive behavior’s such as word of mouth advocacy, irrespective of the marketing pressures generated by the other competing brands (Kotler & Keller, 2006). Singh and Singh (1981) found that consumers had single or multi brand loyalty based on the nature of the Product, like necessaries or luxuries. Padmanaban and Sankaranarayanan (1999) revealed that the price of the preferred brand, efficiency of the preferred brand and influence of advertisement significantly influenced the brand loyalty. Usha (2007) analysed the buying behaviour of consumers for instant food products in Kolar district of Karnataka state and found that high price and poor taste were the reasons for not purchasing a particular brand while best quality, retailers influence, and availability were considered for preferring a particular brand of product by consumers. Kulkarni and Srivastava (2018) disclosed that sales promotion, purchase intention, quality and price have a positive correlation with brand loyalty at varying degrees; nevertheless, there is a fairly good amount of impact of purchase intention on brand loyalty (29.50%), as compared to other variables viz., price (27.8%), sales promotion (18.2%) and quality (11.5%). With this background the present study was carried out with an objective of analyzing the brand loyalty of urban and rural consumers towards branded edible oils in Chittoor district of Andhra Pradesh.

MATERIAL AND METHODS

Chittoor district was purposively selected for the study as it is one of the urbanized districts of the state of Andhra Pradesh. From Chittoor district, based on highest urban population areas viz., Tirupati, Chittoor and Madanapalli were selected. Based on the same criteria i.e., two highest rural population areas corresponding to each urban area were selected thus the rural areas selected for the study were Chellur and Ramireddypalle from Tirupati, Gundlapalle and Aragonda from Chittoor and Bairupalle and Gollapalle from Madanapalli. A sample of 20 consumers from each urban area was selected randomly and from each rural area 10 consumers were selected randomly. Thus, a total of 60 urban consumers and 60 rural consumers constituted the sample of the survey. Simple percentage analysis was employed to examine the brand loyalty of urban and rural consumers towards the branded edible oils.

RESULTS AND DISCUSSION

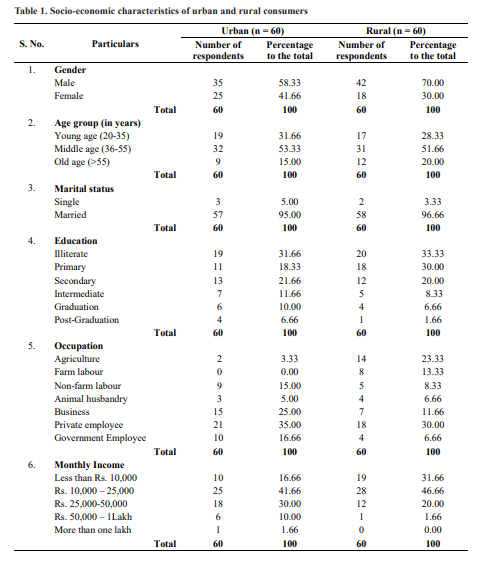

Socio-economic characteristics of sample respondents:

The findings of the study revealed that majority of the respondents in both urban areas and rural areas were male, aged between 36-55 years and were married. About

31.66 per cent and 33.33 per cent respondents from urban and rural areas were illiterates, 35.00 per cent and 30.00 per cent respondents from urban and rural areas were working as private employees and 41.66 per cent and

46.66 per cent respondents from urban and rural areas were earning a monthly income of ` 10,000 to 25,000 (Table 1).

Consumers preference towards different brands of edible oils:

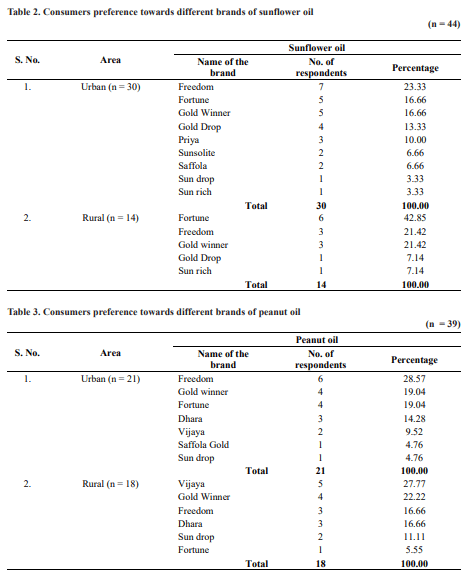

a)Consumer preference towards different brands of sunflower oil:

Regarding to sunflower oil different brands were available in both urban and rural markets. The preference of consumers for different brands of sunflower oil were analysed and presented in Table 2.

From the table it was clear that nine brands of sunflower oil were preferred by urban respondents, about

23.33 per cent of the respondents consume Freedom brand, followed by Fortune (16.66%), Gold Winner (16.66%), Gold drop (13.33%), Priya (10.00%), sunsolite (6.66%), Saffola (6.66%), Sun drop (3.33%) and sun rich (3.33%). With respect to rural areas, 42.85 per cent of the respondents favoured fortune brand followed by Freedom (21.42%), Gold Winner (21.42%), Gold drop (7.14%) and Sun rich (7.14%).

b) Respondents preference towards different brands of peanut oil:

Consumer preference towards different brands of peanut oil consumed in urban and rural areas were analysed and the results were presented in Table 3. In urban areas about 28.57 per cent of the respondents were consuming Freedom brand, Fortune (19.04%), Gold winner (19.04%), Dhara (14.28%), Vijaya (9.52%), Saffola Gold (4.76%) and Sun drop (4.76%). Where as in rural areas 27.77 per cent preferred Vijaya brand, Gold winner (22.22%), Freedom (16.66%), Dhara (16.66%), Sun drop (11.11%) and the remaining 5.55 per cent were consuming Fortune brand.

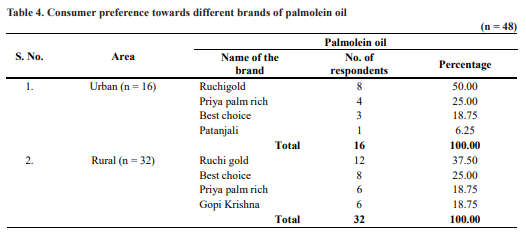

c) Respondents preference towards different brands of palmolein oil:

With respect to brands of palmolein, Ruchi gold is the brand which is mostly used by both urban and rural respondents. In urban areas 50.00 per cent of the respondents were consuming Ruchi gold, Priya palm rich (25.00%), Best choice (18.75%), and Patanjali (6.25%). Whereas in rural areas 37.50 per cent were consuming Ruchi gold, Best choice (25.00%), Priya palm rich (18.75%) and the rest 18.75 per cent of the respondents were consuming Gopi Krishna oil brand (Table 4).

d) Respondents preference towards different brands of sesamum oil:

In case of sesamum oil, 52.94 per cent of the urban respondents were consuming Idhayam, A.S brand (29.41%) and 17.64 per cent were consuming Patanjali. In rural areas 62.50 per cent were using Idhayam, and the rest 37.50 per cent of the respondents were consuming

A.S Brand (Table 5).

Consumers brand loyalty towards branded edible oils:

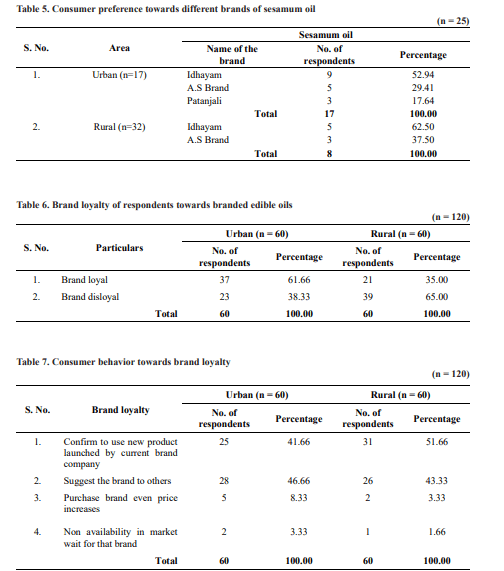

a) Brand loyalty of respondents towards branded edible oils:

Brand loyalty is the tendency of consumers to continuously buy the same brand products over another. The results revealed that 61.66 per cent (Table 2) of the urban respondents were brand loyal and remaining 38.33 per cent were brand disloyal. Whereas in rural areas 65.00 per cent of the respondents were brand disloyal and remaining 35.00 per cent of the respondents were brand loyal. The results indicated that urban respondents were more brand loyal when compared to the rural respondents.

b) Consumer Behaviour Towards Brand loyalty

In urban area 46.66 per cent of the respondents were suggesting the brand to others followed by 41.66 per cent were confirm to use new product launched by current brand company, 8.33 per cent were willing to purchase same brand even price increases and 3.33 per cent were willing to wait for the brand in case of non-availability of preferred brand in the market. Whereas in rural areas

51.66 per cent of the respondents were confirm to use new product launched by current brand company followed by 43.33 per cent were suggesting the brand to others,

3.33 per cent were willing to purchase same brand even price increases and 1.66 percent of the respondents were willing to wait for the brand in case of non-availability of preferred brand in the market (Table 3).

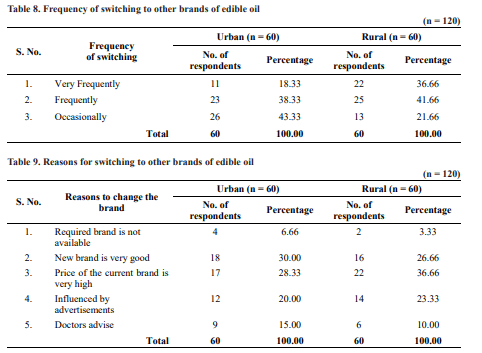

c)Frequency of switching to other brands of edible oil

Table 4 indicated that in urban area 43.33 per cent of the respondents occasionally switched over for other brands followed by 38.33 per cent switched over frequently and only 18.33 per cent switched over very frequently. While in rural areas 41.66 per cent of the respondents switched over frequently followed by 36.66 per cent of the respondents switched over very frequently and only 21.66 per cent occasionally.

d)Reasons for switching to other brands of edible oil

Information related to reason for switch over to other brands of edible oils were analyzed and presented in Table

5. In urban areas 30.00 per cent of the respondents

switched over due to new brand is very good followed by

28.33 per cent due to price of the present brand is very high, influenced by advertisement (20.00%), doctor’s advice (15.00%) and only 6.66 per cent is due to required brand is not available. While in rural areas 36.66 per cent is due to price of the present brand is very high followed by new brand is very good (26.66%), influenced by advertisement (23.33%), doctor’s advice (10.00%) and only 3.33 per cent of the respondents switched over to another brand due to required brand is not available.

The results indicated that Product quality, price and promotional strategies plays an important role in maintain the brand loyalty.

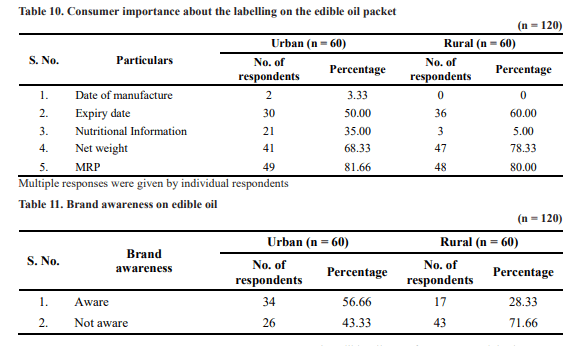

e)Consumer importance about the labelling on the edible oil packet

Consumers importance about the labelling on the various brands of edible oil packets were analyzed and the results were presented in the Table 6. In urban areas

81.66 per cent of the respondents were giving importance to MRP of the product followed by 68.33 per cent to net weight, 50.00 per cent to expiry date, 35.00 per cent to nutritional information and only 3.33 per cent to date of manufacturing of the product. While in rural areas 80.00 per cent of the respondents to MRP of the product followed by 78.33 to net weight, 60.00 per cent to expiry date, 5 per cent to the nutritional information and none of the respondents were giving importance to the date of manufacture of the product in rural areas. The results indicated that majority of the respondents both in urban

and rural areas were look about the labelling on the edible oil packets and they were giving more importance to the labelling aspects before buying oil.

f)Brand awareness on edible oil

Information related to brand awareness on edible oils available in the market were collected from the sample respondents and it was analyzed that in urban area 56.66 per cent of the respondents were aware about the brands and 43.33 per cent were not aware about the brand. Whereas in rural areas majority (71.66 %) was not aware about the brand and only 28.33 percent were aware about the brands available in the market. It seems that most of the rural respondents doesn’t have awareness about brands of edible oils. Edible oil companies have to concentrate more on the advertising strategies in order to raise awareness among the consumers (Table 7).

CONCLUSION

1.The study revealed that 61.66 per cent were brand loyal in urban areas whereas in rural areas only 35.00 per cent were brand loyal.

2.About 46.66 per cent of the respondents in urban areas were suggesting the brands to others, whereas in rural areas 51.66 per cent were confirm to use new product launched by current brand company.

3.About 43.33 per cent of the respondents in urban areas shifted to another brand occasionally, whereas in rural areas 41.66 per cent shifted to another brand frequently.

4.About 30.00 per cent of the respondents in urban areas were shifted to other brand due to the fact that new brand is very good, while 36.66 per cent in rural areas were shifted to other brand due to the fact that price of the present brand is very high.

5.Majority 81.66 per cent of the urban respondents a look for MRP, whereas 80.00 per cent of the rural respondents look for MRP.

6.About 56.66 per cent of the respondents in urban areas and 28.33 per cent in rural areas were aware of all brands.

SUGGESTIONS

1.The brand loyalty among the respondents were less. So, the edible oil business companies have to follow good promotional strategies like giving discounts or special offers and also, should provide consistent quality. If consumers feel value and are getting a fair deal from their loyalty, then they have no chance to shift to other brand.

2.The rural respondents were preferring the brands which are mostly available in the retail outlets. So, those companies which are involved in the edible oil business should concentrate on the availability of their product in each and every store.

3.Most of the respondents were not aware about the various edible oil brands available in the market. So, the edible oil manufacturers are advised to create awareness through many promotional and advertising techniques.

LITERATURE CITED

Kotler, P and Keller, K. 2006. Marketing Management.

Upper Saddle River, New Jersey.

Kulkarni, G and Srivastava, R.K. 2018. Study on impact of sales promotion on brand loyalty of generation- Z for edible oil. International Research Journal of Marketing and Economics. 5(8): 84-104.

Padmanaban, N.R and Sankaranarayanan, K. 1999. Business experience, product linesof dealers and farmers loyalty to dealer for pesticides in southern Tamil Nadu. Indian Journal of Marketing.13(3): 69-74.

Singh, J.D and Raghbir S. 1981. A study of brand loyalty in India. Indian Journal of Marketing. 11(11-12): 33-37.

Usha, V. 2007. A study on buying behavior of consumers towards instant food products in Kolar district. MBA (ABM) Thesis (Unpub.), University of Agricultural Sciences, Dharwad.

- Genetic Diversity Analysis of 64 Maize Inbred Lines for Yield Traits Using D2 Statistics and Principal Component Analysis

- Effect of Border Crops on Activity of Predatory Fauna In Blackgram (Vigna Mungo L.)

- Effect of Organic Nutrient Management Practices on Growth and Yield of Foxtail Millet

- Species Diversity of Sugarcane Shootborers in Major Sugarcane Growing Districts of Andhra Pradesh

- Faunistic Studies on Economically Important Lepidopterans in Different Field Crops of Tirupati District

- Production Potential of Sweet Corn as Influenced by Organic Manures and Foliar Nutrition