A Study on Export Growth of Chittoor Mango and Constraints Faced by Different Actors in Mango Value Chain

0 Views

R. BINDU SOWMYA*, N.T. KRISHNA KISHORE, T. LAKSHMI AND SHAIK NAFEEZ UMAR

Institute of Agribusiness Management, S.V. Agriculture College, ANGRAU, Tirupati-517502.

ABSTRACT

The current study was conducted to analyse the export growth of Chittoor mango and constraints faced by different actors

in Chittoor mango value chain. Various stakeholders in mango value chain comprised of mango growing farmers, pre – harvest

contractors, input suppliers, APMC/Village traders, institutional buyers, processors, wholesalers, retailers, exporters, consumers,

and farmer producer organisations. The Chittoor mango value chain is regarded as complex and diversified because of the

involvement of large no. of intermediaries in the value chain making it less efficient. Despite being the Agri Export Zone,

Chittoor mango belt and Chittoor processing industry and export industry were facing infrastructure bottlenecks. The compound

annual growth rates of quantity of fresh mango exports were estimated as – 6.16 per cent and their value is recorded as 3.81 per

cent. The compound annual growth rates of mango pulp exports are estimated as -5.02 per cent and the value of total exports is

recorded as 1.04 per cent. The major constraints faced by processors were high working capital (82.00) and poor quality of law

material (68.20). The constraints faced by exporters were high freight charges (77.20), stringent norms by importing countries

(72.40) and poor post harvest handling by mango growers (62.40).

KEYWORDS: Mango value chain, value chain actors, constraints, processing, exports

INTRODUCTION

Mango, a tropical fruit, belongs to the family Anacardiaceae, originated from South and Southeast Asia and now is cultivated all around the world. It is known as the “King of Fruits,” which makes it the most popular fruit. Indian mango is one-of-a-kind product that exemplifies great quality and plenty of nutrients it contains. India is the world’s leading mango producer, accounting for more than half of global mango production. It was recorded as

20.32 MT in 2020. But a very a small per cent, nearly 1 per cent of this production was exported to the foreign countries. India exported 21033 MT of fresh mangoes to major destinations like UAE, UK, Qatar, Oman, Kuwait, Singapore, Bahrain Islands, Germany, Canada, Saudi Arabia. India is also a top exporter of mango pulp. It exported 98370 MT of mango pulp to the major destinations like Saudi Arabia, the Netherlands, Kuwait, Oman, China, the United States, the United Kingdom, Germany, Sudan, and Yemen Republic. In India, Andhra Pradesh state ranks first in area of cultivation with 14.72 per cent. While Uttar Pradesh ranks first in production and productivity of mango (23.47 and 23% respectively) followed by AP (Production: 23.63% i.e., 4.6 million tonnes), Karnataka, Bihar, Gujarat, Tamil Nadu, Odisha, West Bengal, Jharkhand, and Maharashtra. (APEDA, Ministry of Commerce and Industry, Government of India). In India, Chittoor district ranks first in both area and production of the mango. Chittoor district contributes 15.5 lakh tonnes from 1.12 lakh ha, with table variety mangoes such as Banishan (Banginapalle), Dashehari, Kesar, Himayath, and others. While 86000 hectares are home to the Totapuri mango variety, which is primarily used in the pulp industry. The processing industry is concentrated in the Chittoor district, which serves as a major hub for the export of mango pulp to various countries. In Chittoor, the main sucking varieties are Cinnarasam, Peddarasam, and Navaneetham, and the main pickle varieties are Jalal, Amini, and Hyder saheb. (Source: National Mango Database, Department of Biotechnology). In agriculture, the value chain refers to the set of actors (private, public, and service providers) and the sequence of value-adding activities involved in moving a product from production to the final consumer. Farmers, input suppliers, private traders, processors, exporters, and consumers are all involved in the Chittoor mango value chain. The efficiency of value chains is decreasing as the mango value chain diversifies and becomes more complex due to the increased presence of middlemen. The current study is being conducted to examine mango exports from India and identify various challenges faced by different actors of mango value chain in Chittoor district of Andhra Pradesh.

MATERIAL AND METHODS

Andhra Pradesh was selected for the current study because it stands first in terms of area under mango cultivation and stands second in terms of production and productivity. From this state, Chittoor district was selected because Chittoor district ranks first in both area and production of the mango. Two mandals were selected purposively based on highest production and 2 villages from each mandal were selected purposively based on high mango production. 10 mango growing farmers from each village were selected randomly making up to 40 farmers. Other stake holders like input suppliers, traders, pre – harvest contractors, institutional buyers, FPOs, processors, wholesalers, retailers, exporters and consumers of each 5 actors were selected based on purposive random sampling. The required data will be gathered using survey methods and a pre-tested schedule in 2021-22. Various stakeholders were surveyed to gather information about mango value chains, and value addition facilities, etc. The data obtained was analysed to attain specific objectives by using Annual growth rates, compound annual growth rate, Percentage analysis and Garrett ranking technique to prioritize constraints faced by value chain actors.

RESULTS AND DISCUSSIONS

Status of the fresh mango exports from India

Table 1 interprets that export of the fresh mango in India had significantly decreased from 63441.26 metric tons to 27872.77 metric tons. Unlike, the value of these increased from ` 20,974.28 lakhs to ` 32,745.12 lakhs. The highest export was recorded in 2012-2013 with 55,584.98 metric tons and the highest revenue was recorded in 2016-17 with ` 44366.03 lakhs. The annual growth rate (AGR) with respect to fresh mango export quantity and their value was highest during 2016-2017 with 43.45 per cent and 38.37 per cent respectively. During 2020-2021, the fresh mango exports saw a negative AGR of -57.64 in view of the Covid-19 pandemic situation which caused the halt of exports from the country. The compound annual growth rates (CAGR) of quantity of fresh mango exports reported negative growth rate of -6.16 per cent and their value was recorded as 3.81 percent.

Table 1. Growth rates of fresh mango exports from India

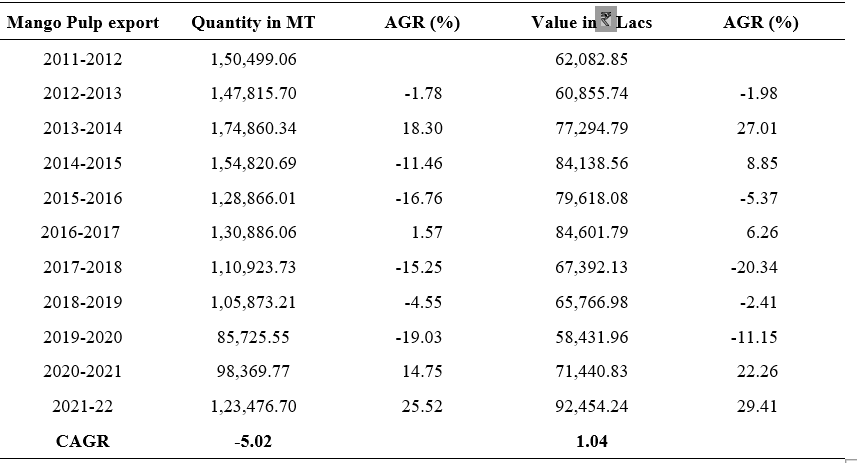

Table 2. Growth rates of mango pulp exports from India

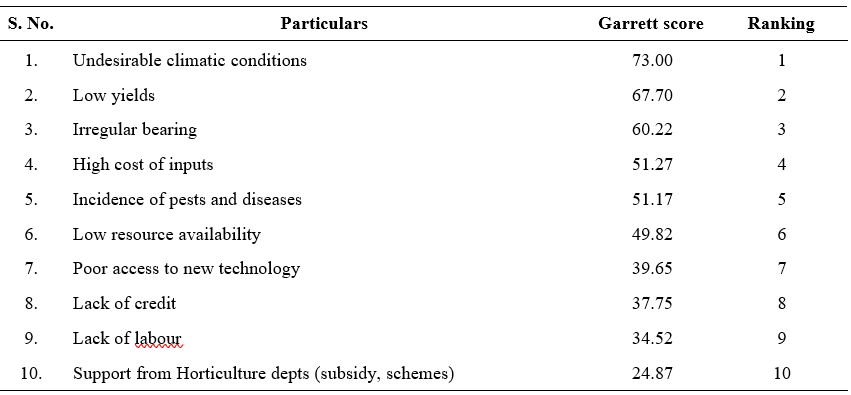

Table 3. Constraints faced by farmers during production

Status of Mango pulp exports from India

The Table 2 interprets that the export of mango pulp in India has significantly decreased from 150499.06 metric tons to 123476.70 metric tons. Unlike, the value of pulp exports increased from ` 62,082.85 lakhs to ` 92454.24 lakhs. The highest export was recorded in 2013- 2014 with 174,860.34 metric tons and the highest value of exports was recorded in 2021-22 with ` 92454.24 lakhs. The annual growth rate (AGR) with respect to fresh mango export quantity and their value was highest in the year 2021-2022 with 25.52 per cent and 29.41 per cent respectively. The compound annual growth rates (CAGR) of mango pulp exports are estimated as -5.02 per cent and the value of total exports was recorded as 1.04 per cent. (Source – APEDA).

Constraints faced by farmers during production of mango:

The results from the Table 3 indicates the various constraints faced during production of the mango by the farmers in the study area. It is clearly seen from the scores presented in the table that at the production level the biggest constraints faced by the farmers are undesirable climatic conditions (73.00), lower yields (67.70), where in several farmers experienced the lowest yields due to the undesirable climatic conditions like unprecedented heavy rains received during actual flowering and fruit setting stage, resulting in higher-than-usual moisture in the soil and extended winter cold temperatures led to a delay in flowering, which led to a delay in fruit setting too. This complements the third major constraint irregular bearing (60.22), together led to down fall of yields as low as 50 – 30 per cent. The other main constraints were high cost of inputs (51.27) followed by incidence of pests and diseases (51.17). Few farmers also complained about the low resource availability (49.82) especially the water availability for irrigation of mango orchards. These constraints are followed by poor access to new technologies (39.65), lack of credit (37.75) lack of labour (34.525) and few farmers felt a lack of support from horticulture departments for various subsidies and schemes.

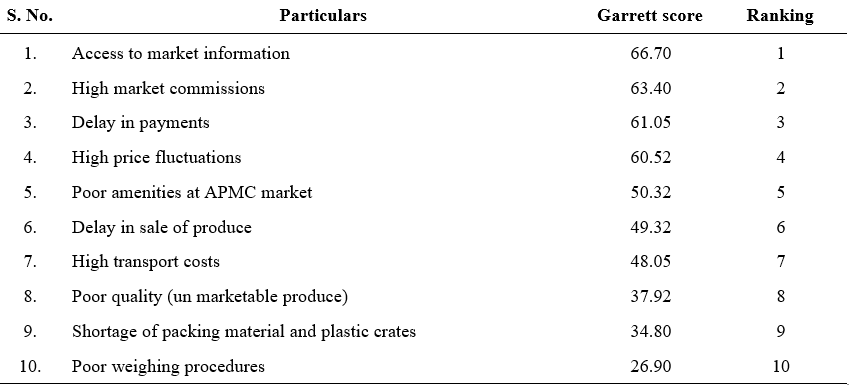

Constraints faced by farmers during marketing of mango:

The results from Table 4 indicates that the primary problem that most of the farmers faced were lack of access to market information (66.70) as most of the farmers were not being able to know the better marketing channels for the better price realisation for their produce. The next constraint was high market commissions (63.40) which were being borne by the farmers in APMC markets as high as 5 – 10 per cent per ton of produce. Many farmers also complained about delay in payments (61.05). Another main constraint was high price fluctuations (60.52) as prices of mango were majorly affected by demand and supply in the market which drastically changes day to day followed by poor amenities at APMC market (50.32) like lesser infrastructure availability for the storage of produce and

Table 4. Constraints faced by farmers during marketing

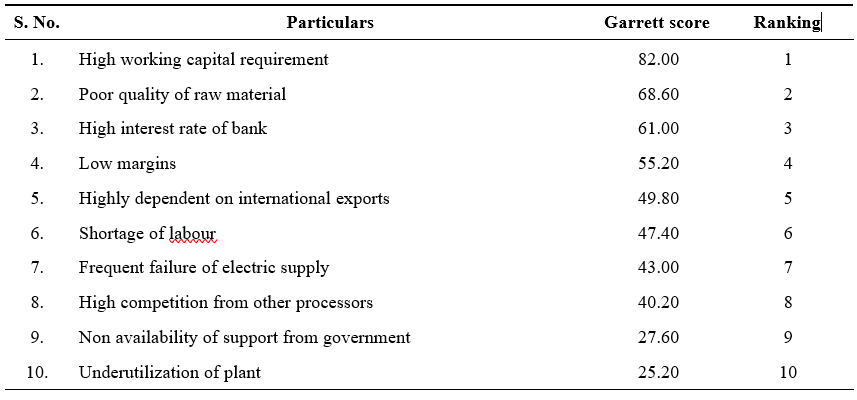

Table 5. Constraints faced by the processors

lack of facilities to accommodate higher tonnages during bumper season. This complements the next constraint of delay in sale of produce (49.32). Few farmers also complained about high transport costs (48.05), Poor quality (un marketable produce) (37.92), shortage of packing material and plastic crates (34.80) during peak season and poor weighing procedures (26.90).

Constraints faced by the processors in the mango value chain of Chittoor district

The results from Table 5 showed that major constraints faced by processors were high working capital requirements (82.00) as especially the costs for purchasing raw material and packing material was so high. The next major constraint was poor quality of raw material (68.60) affecting the quality of pulp. Many farmers also complained about high bank interest rates (61.00). Other constraints were low margins (55.20) complemented by another constraint highly dependent on international exports (49.80) as they were focussing more on international exports for higher profits. Other constraints include shortage of labour (47.40), frequent failure of electric supply (43.00), high competition from other processors (40.20), non – availability of support from government (27.60) and least score was given to under utilization of plant (25.20).

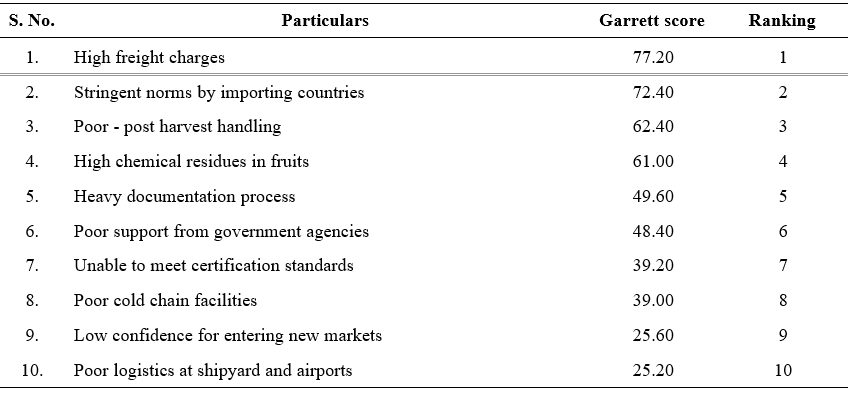

Constraints faced by the exporters in the mango value chain of Chittoor district

The results from Table 6 showed that major constraints faced by exporters were high freight charges (77.20). The freight charges for export of mangoes to foreign countries had doubled nearly compared to the pre – pandemic stage. This had decreased the profits for exporters in mango exports. The next biggest constraint was stringent norms by importing countries (72.40) as different foreign countries need different specifications about phyto sanitary norms for the products that were being importing by those countries. Many expoeters also complained about the poor post – harvest handling (62.40) as most of the farmers were not following the desapping procedure properly leading to burns on the mango fruit thereby decreases the quality of the mango. Other constraints were High chemical residues in fruits (61.00), heavy documentation process (49.60), as exporters need to maintain many documents / certifications to export their produce, unable to meet certification standards (39.20), poor cold chain facilities (39.00), low confidence for entering into new markets (25.60) and poor logistics at shipyard and airports (25.20).

The Chittoor mango value chain is more diversified and complex because of the presence of number of intermediaries. These intermediaries intervention was decreasing the efficiency of value chains by lowering the margin levels of producers. The farmers were facing problems due to the presence of traders and their commission charges. The processors were facing problems due to high working capital requirements, high bank interest rates and poor quality raw material. The exporters were facing the problems due to stringent norms of importing countries and poor post harvest handling of

Table 6. Constraints faced by the exporters

produce. Therefore, the policy makers should focus on encouraging the infrastructure development in order to make the Chittoor mango value chain more efficient and sustainable.

LITERATURE CITED

Sharma, D.D and Khurana, G.S. 2000. Fertilizers application in mango orchards. Indian Journal of Extension Education. 36(1 and 2): 58-64.

Karthick, V., Mani, K and Anbarassn, A. 2013. Mango pulp processing industry in Tamil Nadu – An economic analysis. American International Journal of Research in Humanities, Arts and Social Sciences. 2328-3628.

Nandika and Jayasree Krishnakutty. 2017. The study on Stakeholder Analysis for Farmer inclusive Value chain Development in Mango in Palakkad district of Kerala. Journal of Extension Education. 29(1): 2017.

Agricultural and Processed Food Products Export Development Authority of India. 2020. Fresh fruits and vegetables census report 2020-2021. Ministry of Commerce and Industry, Government of India.

- Genetic Divergence Studies for Yield and Its Component Traits in Groundnut (Arachis Hypogaea L.)

- Correlation and Path Coefficient Analysis Among Early Clones Of Sugarcane (Saccharum Spp.)

- Character Association and Path Coefficient Analysis in Tomato (Solanum Lycopersicum L.)

- Survey on the Incidence of Sesame Leafhopper and Phyllody in Major Growing Districts of Southern Zone of Andhra Pradesh, India

- Effect of Organic Manures, Chemical and Biofertilizers on Potassium Use Efficiency in Groundnut

- A Study on Growth Pattern of Red Chilli in India and Andhra Pradesh