Consumers’ Buying Behaviour Towards Organic Foods in Retail Outlets of Ananthapuramu City, Andhra Pradesh

0 Views

DEVARINTI CHANDRIKA*, A. LALITHA, N. VANI AND B. RAMANA MURTHY

Institute of Agribusiness Management ,S.V. Agricultural College, ANGRAU, Tirupati-517 502.

ABSTRACT

This study explores consumer buying behaviour towards organic foods in Ananthapuramu city, Andhra Pradesh, based on a survey of 150 respondents across five retail outlets. The study aimed to assess awareness, preferences, willingness to pay, price acceptance and the influence of demographic variables. The majority of consumers were aged 21-35 years, held undergraduate degrees and earned ₹25,001-₹50,000 monthly. Grains followed by millets, vegetables, fruits and pulses were the most preferred organic categories, while meat, eggs and baby foods were least preferred. Nearly half the respondents were willing to pay a premium, mainly up to 20 per cent, with most allocating 11-30 per cent of their monthly food budget to organic products. Factor analysis revealed ten key behavioural influences such as health and safety, environmental and ethics, reference group, awareness, affordability and availability, convenience, credibility, brand and promotional, palatability and visual appeal explaining 73.81 per cent of total variance. Age and income significantly influenced several behavioural factors. The study highlights the need for affordable pricing, trust-building and awareness campaigns to strengthen organic food adoption in Tier- II cities.

KEYWORDS: Organic food, Consumer behaviour, Factor analysis, Price acceptance, Willingness to pay.

INTRODUCTION

India’s agricultural sector is witnessing a shift as health concerns, environmental degradation, and food safety issues drive consumer interest toward organic products. Organic farming, which avoids synthetic inputs and promotes sustainable practices like composting and crop rotation, offers a viable solution. Globally, the organic food market crossed USD 350 billion by 2025, with India emerging as a leader in certified organic production (FiBL and IFOAM, 2025).

Urban centers like Ananthapuramu are seeing growing demand for organic foods, driven by rising awareness and income. Yet, challenges such as limited awareness, price sensitivity, and certification trust continue to impact consumer adoption. This study examines consumer awareness, preferences, willingness to pay for organic foods, factors influencing the buying behaviour and chi-square test was adopted to explore the association of identified factors with demographic variables.

MATERIAL AND METHODS

The study was conducted in Ananthapuramu city, Andhra Pradesh, using an ex-post facto research design. A total of 150 organic food consumers were selected through judgmental sampling from five purposively chosen retail outlets. Statistical tools used include descriptive statistics, Garrett’s Ranking, Chi-square test, Cross-tabulation and Factor analysis. Data were collected using structured interviews and google forms covering demographics, willingness to pay and price acceptance. Consumer price acceptance was measured using Likert scale statements and categorized into 3 based on mean and standard deviation. Factor analysis with PCA and varimax rotation was applied to identify key behavioural dimensions. The suitability of data was confirmed using KMO and Bartlett’s tests. Chi-square tests were used to examine the association between demographic variables and the identified factors.

RESULTS AND DISCUSSIONS

-

Socio-Economic Profile of The Consumers

Table 1 shows that out of 150 respondents, more than half (54.0%) were male and 46.0 per cent were female. A majority (52.0%) were aged 21-35 years; these results are in line with findings of Kataria et al. (2019) and Magesh and Rajeswari (2024). With regard to education most of the respondents (56.0%) studied undergraduate or higher. In terms of income 39.3 per cent of them earned ₹25,001-₹50,000 and 28.0 per cent earned ₹50,001-₹1,00,000. Regarding marital status, 52.7 per cent of them were married. The largest occupational group was private employees with 27.3 per cent followed by business/self-employed (18.0%), students (16.7%) & homemakers (16.0%). Over 54.0 per cent of them belonged to households with 4-6 members. These findings suggest that organic food consumption is driven by a younger, educated and economically stable population whose awareness, digital access and health consciousness contribute to their willingness to pay a premium & accept existing price levels for organic food.

I. Consumer Awareness and Buying Behaviour Towards Organic Foods

Table 2 indicates that the total number of the sample respondents was 150. Among them 68.7 per cent had been aware of organic foods for over three years, while only 4.0 per cent had recent awareness, indicating limited new consumer reach. Social media was the leading source of awareness (30.7%), followed by in- store promotions (22.0%) and friends/family (16.0%). Awareness of organic certifications remained low, with

46.0 per cent showing limited understanding. With regard to frequency of purchase, nearly half (49.3%) of the respondents had quarterly purchase and 22.0 per cent had monthly followed by fortnightly (18.0%), occasionally (6.0%) and weekly (4.7%).

Organic outlets (44.0%) and supermarkets (29.3%) were the main places of purchase, while in-person buying (57.3%) remained the preferred mode. Long-term users (over 3 years) accounted for 38.7 per cent, showing stable loyalty, with only 16.0 per cent being recent adopters. Regarding brand consideration, less than half (41.3%) considered brand as important, 37.3 per cent did not felt. However, 21.3 per cent were neutral, which reflects mixed preferences between brand trust and other attributes like price or origin.

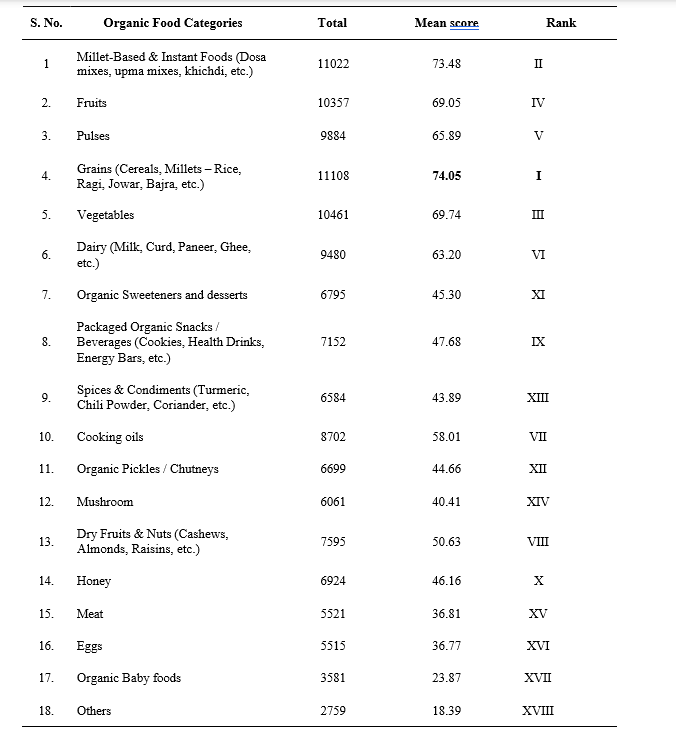

Table 3 indicates that grains (mean score: 74.05), millets/instant foods (73.48) and vegetables (69.74) were the most preferred organic categories, while baby foods (23.87%), meat (36.81%) and eggs (36.77%) were least preferred, this preference pattern in the current study is also supported by Tanishka and Thangavel (2021).

II. Consumers’ Willingness to Pay and Price Acceptance of Current Retail Prices

3.1.Consumers’ willingness to pay, extent of premium and expenditure share on organic foods

Table 4 outlines respondents’ willingness to pay a premium, the extent of that premium and their monthly expenditure on organic foods. About 48 per cent of the respondents were willing to pay more and 30 per cent were uncertain followed by 22 per cent were unwilling, these results indicating a cautiously receptive attitude towards premium pricing. Among these, 27.3 per cent preferred an 11-20 per cent premium and 23.3 per cent accepted up to 10 per cent, suggesting greater tolerance for modest price hikes. Only a smaller segment (14.7% and 12.7%) was open to premiums above 20 per cent.

Regarding expenditure 42 per cent allocated 21-30 per cent of their monthly food budget to organic foods next by 28.7 per cent respondents allocating 11-20 per cent. Less than one tenth of the respondents reported spending more than 30 per cent, reflecting that while organic foods are increasingly mainstream, affordability still shapes spending patterns. These findings align with Tanishka and Thangavel (2021).

3.2 Consumers’ Acceptance of Current Prices for Organic Food Products

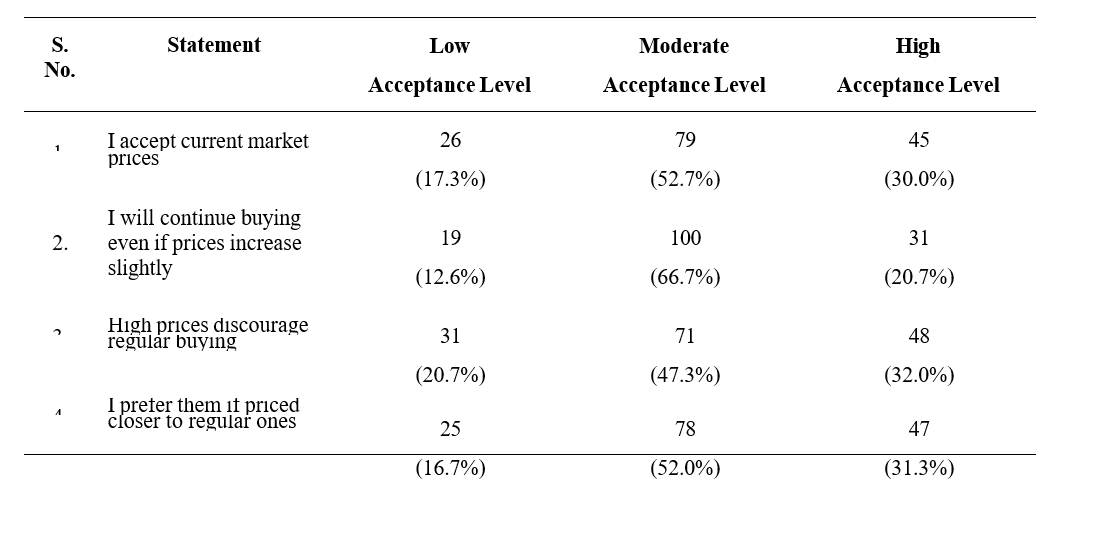

Table 5 presents the level of consumer acceptance toward the current pricing of organic food products, categorized across four key statements. Responses were grouped into low, moderate and high acceptance levels to assess varying degrees of consumer sentiment regarding pricing flexibility, continued purchasing and price-related preferences.

The analysis revealed that over half of the respondents (52.7%) moderately accepted current market prices, while 30.0 per cent expressed high acceptance, reflecting a generally balanced outlook. When asked about continued purchasing despite slight price increases, majority (66.7%) showed moderate acceptance and (20.7%) high acceptance, indicating resilience towards minor price fluctuations. However,

32.0 per cent of consumers strongly agreed that high prices discourage regular buying, with nearly half (47.3%) showing a moderate response highlighting price as a potential barrier. Notably, 52.0 per cent moderately agreed and 31.3 per cent strongly agreed that they

Table 1. Socio-economic profile of the consumers

Table 2. Consumer awareness and buying behaviour towards organic foods (n=150)

Table 3. Most preferred categories of organic foods among the sample respondents (n = 150)

Table 4. Consumers’ willingness to pay, extent of premium and expenditure share on organic foods (n=150)

Table 5. Consumers acceptance of current prices for organic foods (n = 150)

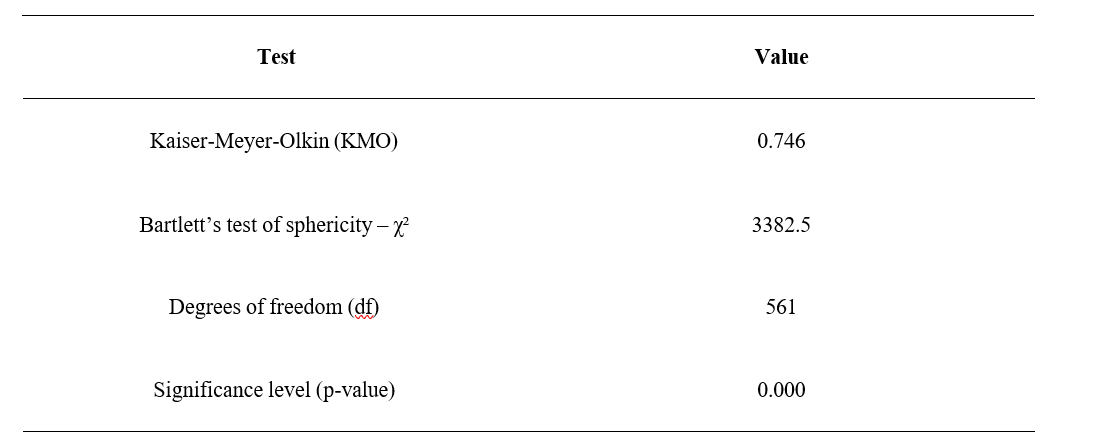

Table 6. KMO and Bartlett’s Test of Sphericity

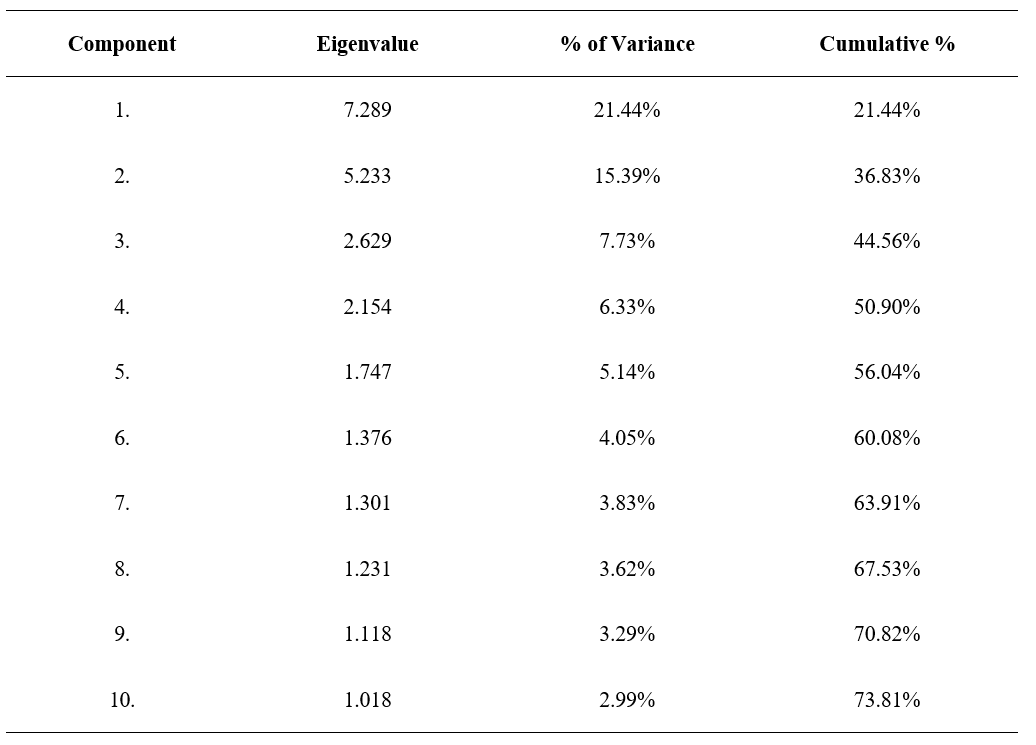

Table 7. Total Variance Explained by Extracted Factors

would prefer organic products if priced closer to regular items, emphasizing the role of comparative pricing in influencing consumer decisions.

The results align with Aryal et al. (2009) and Nandi et al. (2016) who found consumers were willing to pay extra for organic products, mainly driven by health and quality concerns.

- FACTORS INFLUENCING CONSUMERS’ BUYING BEHAVIOUR TOWARDS ORGANIC FOODS

4.1.KMO and Bartlett’s Test of Sphericity

The adequacy of data for factor analysis was verified using the Kaiser-Meyer-Olkin (KMO) measure and Bartlett’s Test of Sphericity. The KMO value was 0.746, indicating sampling adequacy. Bartlett’s Test of Sphericity was significant (χ² = 3382.5, df = 561, p < 0.000), supporting the suitability of the data for factor analysis.

- Factor Extraction and Variance Explained

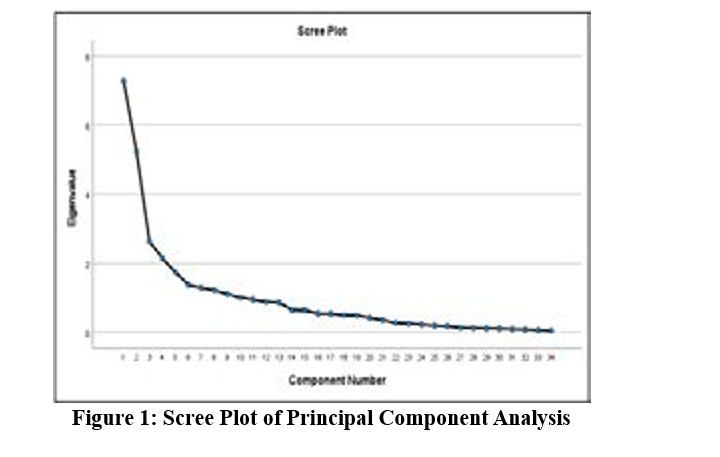

Principal Component Analysis (PCA) was used to extract the key dimensions influencing consumer behaviour. Ten factors were retained based on eigen values greater than one, collectively explaining 73.81% of the total variance. The first three components alone accounted for 21.44%, 15.39% and 7.73% respectively, suggesting a strong data structure.

- SCREE PLOT

The scree plot illustrates the eigenvalue distribution for the 34 components, with a distinct elbow at the 10th component. This supports the retention of ten factors, aligning with Kaiser’s criterion (eigenvalues >1) and the cumulative variance of 73.81 per cent. Beyond this point, additional components contribute minimally.

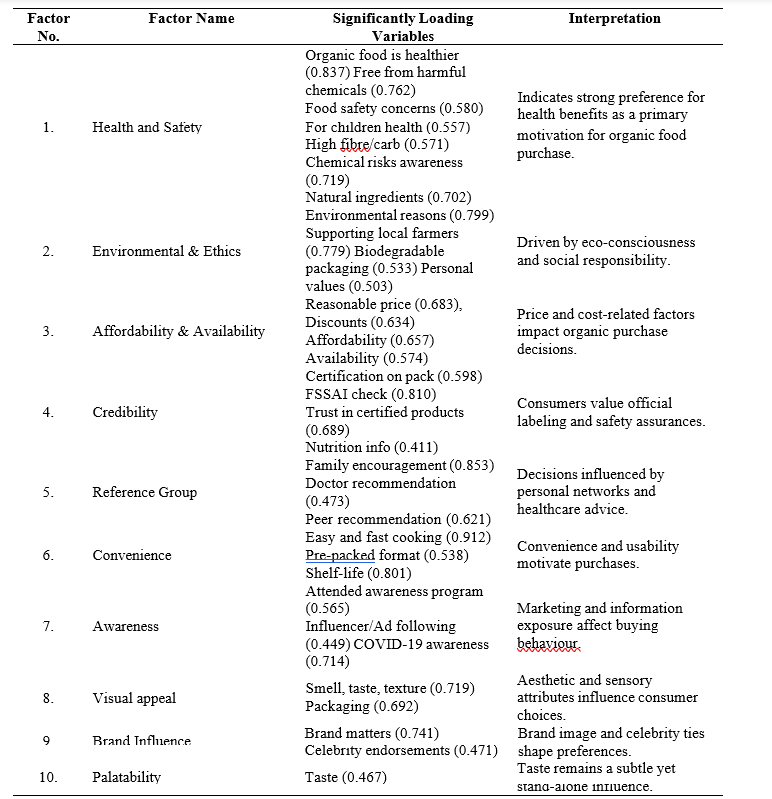

- .Factor Interpretation and Naming:

Based on the rotated component matrix using Varimax rotation, 10 significant factors were identified. Each factor consists of items with high loadings (≥ ±0.4), grouped & named in the following Table 8.

Factor analysis revealed that consumer buying behaviour towards organic food products is influenced by a diverse set of factors. Health and safety, environmental and ethics, affordability and availability, reference group, awareness, convenience factor and credibility factor attributes emerged as dominant influencers. This multi- dimensional insight can help retailers and marketers tailor their strategies to address specific consumer motivators more effectively. The findings align with Basha et al. (2015) and Sivathanu (2015), who reported that health, environment, awareness and convenience strongly influenced organic food choices supporting the top-ranked factors in the present study.

- Association Between Demographic Variables and Behavioural Factors

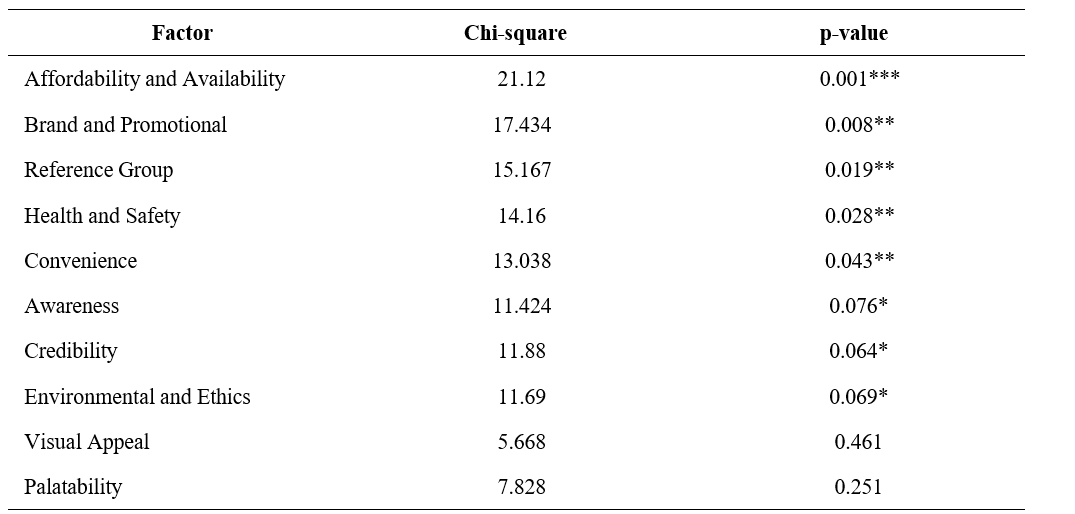

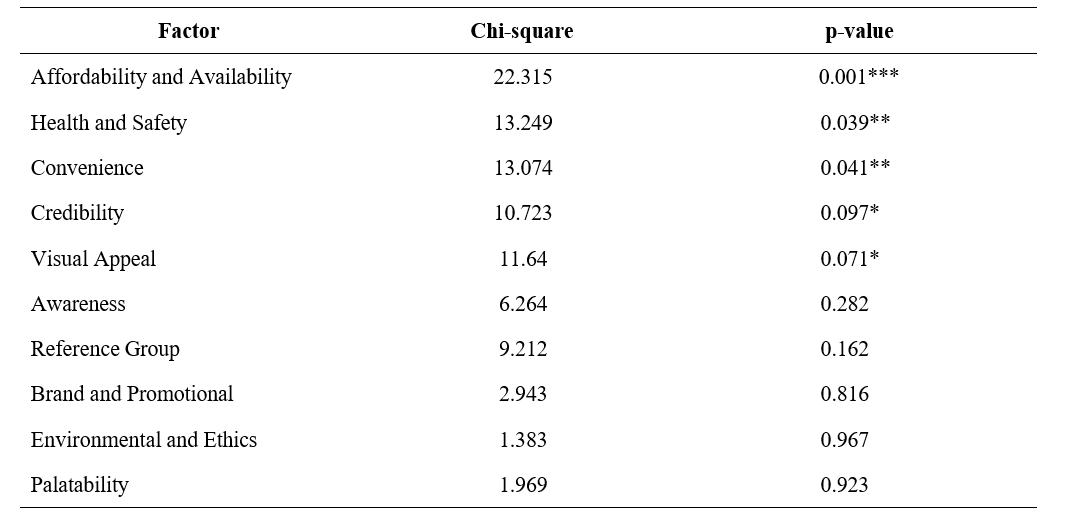

Chi-square tests were conducted to examine the association between demographic characteristics (age and income) and the extracted behavioural factors. Significance levels were tested at 1%, 5% and 10%.

Table.8 Summary of Factors Extracted from Factor Analysis

Table 9. Association with Age

Table 10. Association with Income

INTERPRETATION

Chi-square analysis showed that, from Table 9 it indicates that age significantly influenced five factors, notably affordability, brand and promotion, reference group, health and safety and convenience. Marginal influence was observed for awareness, credibility and environmental ethics, while visual appeal and palatability showed no significant variation with age.

From Table 10 it indicates that income significantly affected affordability, health & safety and convenience, with moderate influence on credibility and visual appeal. other factors such as awareness, brand and promotional, reference group, palatability and ethical concerns were found to be non-significant with income.

The study highlights that organic food consumption in Ananthapuramu city is primarily driven by a younger, educated and economically active population with growing awareness of health and sustainability. Grains, millets, vegetables and fruits were the most preferred categories and nearly half of the respondents expressed a willingness to pay a premium, though mostly within a modest range of 10-20 per cent. Despite moderate to high acceptance of current prices, affordability remains a barrier, especially for frequent consumption. Factor analysis revealed ten significant behavioural dimensions, including health and safety, environmental & ethics, affordability & availability, credibility, brand and promotion, palatability, visual appeal, reference group, awareness and convenience explaining 73.81 per cent of the total variance. The chi-square analysis further established that demographic factors such as age and income significantly influence several of these behavioural aspects.

To expand the organic food market in Tier-II cities like Ananthapuramu, it is crucial to implement targeted pricing strategies, improve consumer trust through transparent certification and enhance awareness campaigns. These insights can guide policymakers, retailers and marketers in developing more inclusive and effective strategies for promoting organic food consumption at the grassroots urban level.

LITERATURE CITED

Aryal, K., Chaudhary, P., Pandit, S and Sharma, G. 2009. Consumers’ willingness to pay for organic products: A case from Kathmandu Valley. The Journal of Agriculture and Environment. 10: 12-22.

Basha, M.B., Mason, C., Shamsudin, M.F., Hussain, H.I and Salem, M.A. 2015. Consumers attitude towards organic food. Procedia Economics and Finance. 31: 444-452.

FiBL and IFOAM – Organics International. 2025. The World of Organic Agriculture: Statistics and Emerging Trends 2025. Frick, Switzerland and Bonn, Germany.

Kataria, Y., Krishna, H., Tyagi, V and Vashishat, T. 2019. Consumer buying behavior of organic food products in India through the lens of Planned Behavior Theory. Research Journal of Humanities and Social Sciences. 10(1): 60-67.

Magesh, R and Rajeswari, M. 2024. A study on consumer perception on organic products and its certification over making purchase decision in chennai. Academy of Marketing Studies Journal. 28(1). 1-8.

Nandi, R., Bokelmann, W., Gowdru, N.V and Dias, G. 2016. Factors influencing consumers’ willingness to pay for organic fruits and vegetables: Empirical evidence from a consumer survey in India. Journal of Food Products Marketing. 23(4): 430-451.

Sivathanu, B. 2015. Factors affecting consumer preference towards the organic food purchases. Indian Journal of Science and Technology. 8(33): 1-6.

Tanishka, S and Thangavel, M. 2021. Awareness and preference towards organic food products during Covid-19 pandemic in Andhra Pradesh. International Journal of Research in Commerce, IT & Management. 2321-9459.

- Effect of Sowing Window on Nodulation, Yield and Post – Harvest Soil Nutrient Status Under Varied Crop Geometries in Short Duration Pigeonpea (Cajanus Cajan L.)

- Nanotechnology and Its Role in Seed Technology

- Challenges Faced by Agri Startups in Andhra Pradesh

- Constraints of Chcs as Perceived by Farmers in Kurnool District of Andhra Pradesh

- Growth, Yield Attributes and Yield of Fingermillet (Eleusine Coracana L. Gaertn.) as Influenced by Different Levels of Fertilizers and Liquid Biofertilizers

- Consumers’ Buying Behaviour Towards Organic Foods in Retail Outlets of Ananthapuramu City, Andhra Pradesh